Pandemic fuels explosive growth in online shopping

Although the pandemic since 2020 has not fully ended, it can be certain that the e-commerce bonanza brought by it has ended. With the large layoff of Facebook’s parent company Meta, Amazon’s Q3 2022 losses and the stock plummet of Shopify and Zoom video conference company back to pre-pandemic levels, the online bonanza brought by remote work has come to an end. This ending has caught many cross-border e-commerce sellers off guard, and overseas warehouses providing supporting services are also facing a surplus of supply.

Let’s briefly review what happened in the past three years. At the beginning of 2022, the new coronavirus pandemic swept the world, and almost all companies began to let employees work from home and schools started online teaching, while the restaurant and offline retail industries were hit. However, online sales boomed at the same time, and more and more sellers joined in, and offline retail also shifted and strengthened online sales. At that time, the industries related to it rapidly developed. Amazon’s stock price continued to reach new highs, and online sales platforms such as Shopify also developed, with Shopify even proposing a big development plan for building its own logistics system.

In the past three years, the COVID-19 pandemic led to widespread work-from-home and online education policies, causing a decline in in-person retail and dining. However, online sales boomed, leading to an increase in online sellers and the shift of offline retail to online. This resulted in rapid growth in industries related to online sales, with companies like Amazon and platforms like Shopify experiencing increased success and expansion plans. At the time, it was believed that this was the new normal, at least for the next decade, and new investments continued to pour into the industry. Overseas warehouses and local delivery, which support e-commerce businesses, also started to grow rapidly, with many new players entering the market. In the Los Angeles area, many small-to-medium-sized overseas warehouses (around 10,000 sq ft) appeared due to the high demand for inventory during the pandemic. These warehouses require a commitment of 3 to 5 years, and the new players must forecast business volume for the next 3 to 5 years to cover their storage and operating costs. The high demand during the pandemic made it difficult to find available warehouses in the Los Angeles area.

Why did the online boom disappear so quickly?

However, just less than three years later, this boom quickly disappeared, even leaving many players stunned and not knowing what happened. Many big platforms started to search and started massive layoffs, with Amazon as the typical representative.

Offline shopping remains the mainstream in the US market

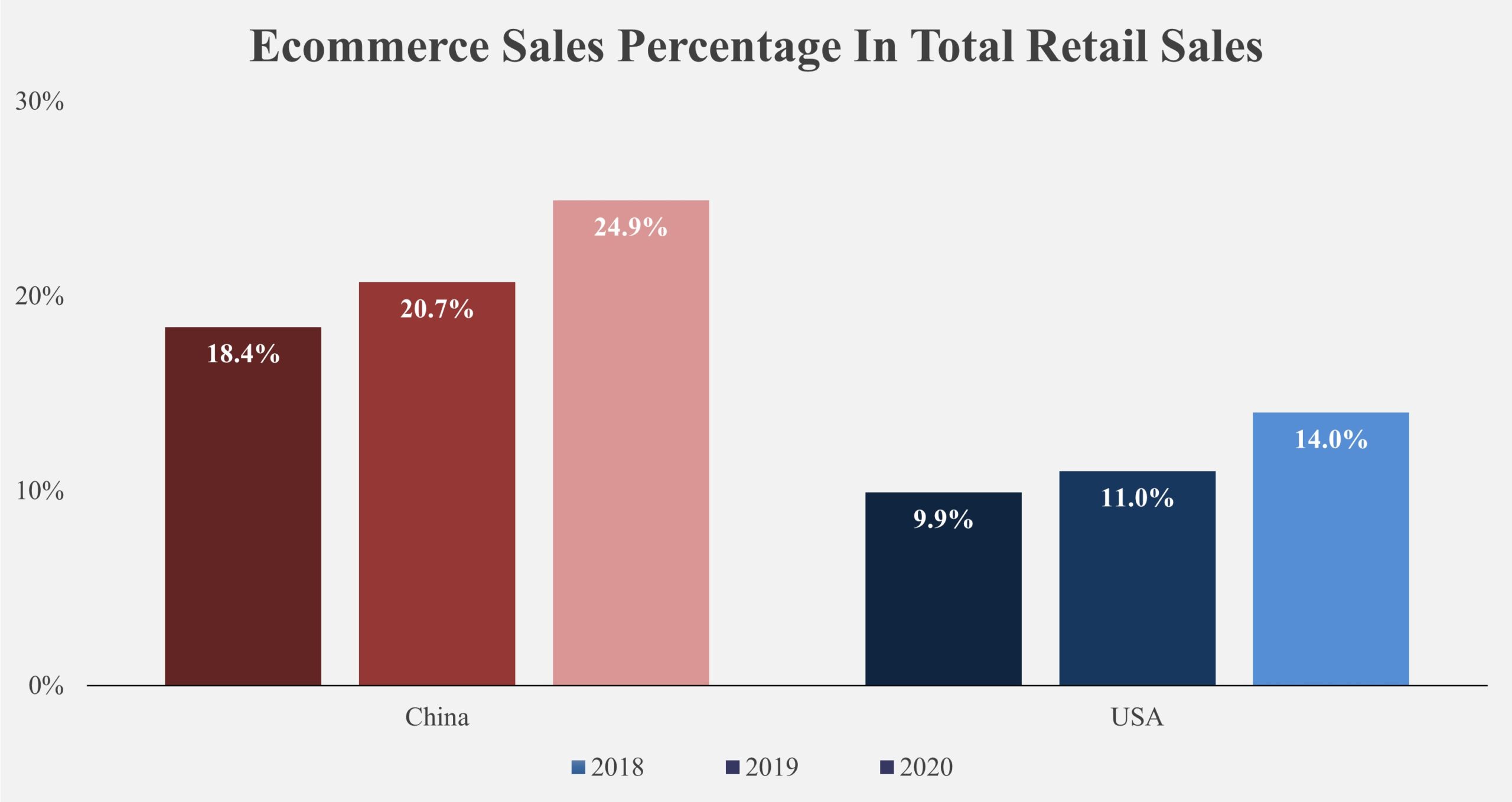

The data shows that the global online sales experienced a significant growth due to the pandemic. From 2018 to 2020, the proportion of online sales in China increased from 18.4% to 24.9%, while in the US it rose from 9.9% to 14.0%. However, unlike China, the overall base of online sales in the US is still low, largely determined by the consumer habits and developed retail sector. Hence, offline retail still dominates the US market and this consumer habit is unlikely to change in the short term, especially due to an uncontrollable external factor. Once this external factor is eliminated, the market will immediately return to normal, and even offline retail may have a compensatory rebound. Thus, it is a mistake to believe that the pandemic has fundamentally changed the online-offline consumption habits, as it may exist in the short term but long-term trend change still requires a long time to occur.

Decline in consumption due to high inflation

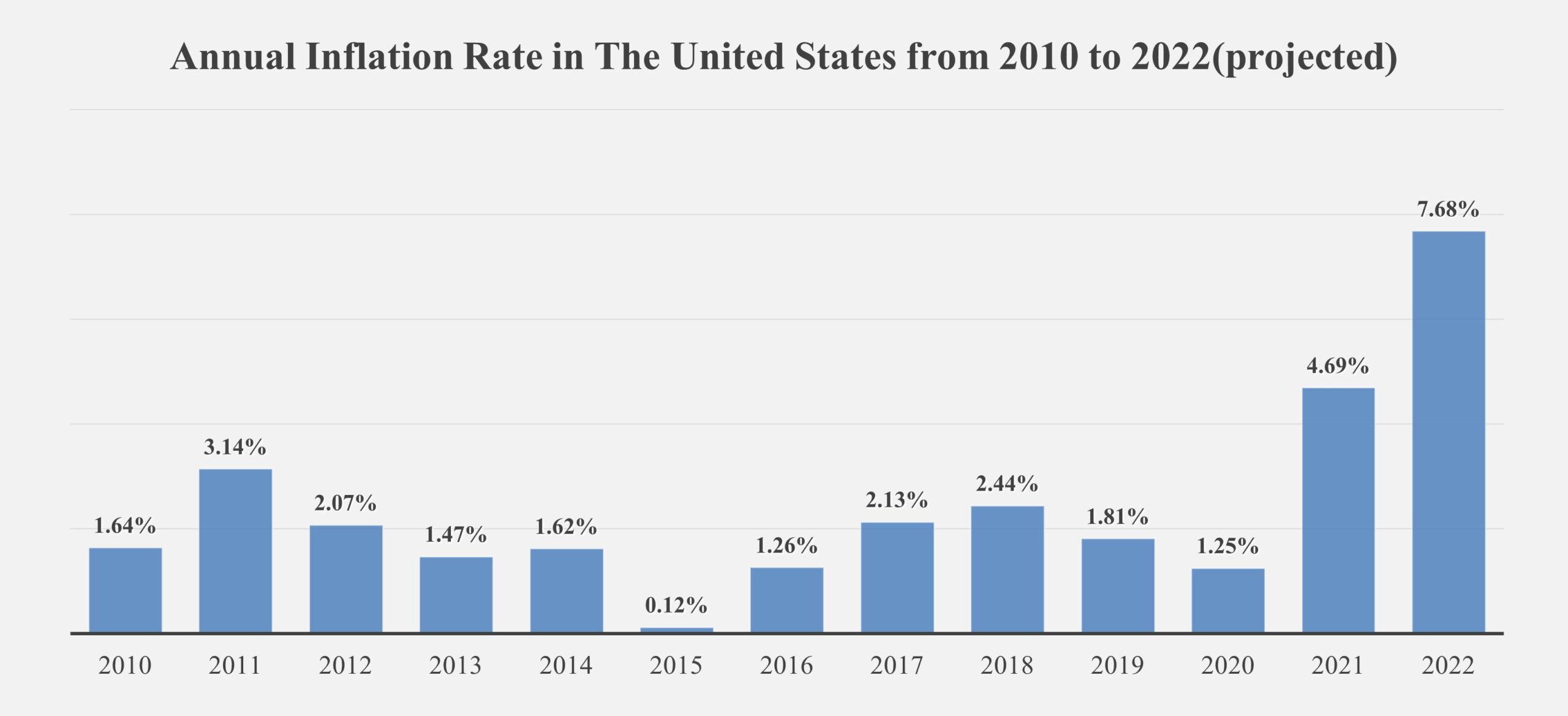

Starting from 2021, the US is in a period of high inflation. The annual inflation rate in 2021 was 4.69%, the highest since 2010, and the expected annual inflation rate in 2022 is expected to reach 7.68%. The Federal Reserve is suppressing inflation by means of interest. This will bring two impacts, on the one hand prices go up, making consumers reduce spending, on the other hand, the cost of interest on loan consumption further increases, also reducing loan-based consumption. Therefore, consumers begin to consider cutting non-essential and advance spending, choosing necessary spending in the present.

E-commerce platform sales are mostly non-essential expenses

Another phenomenon is that products sold through e-commerce platforms are mostly non-essential expenses and are considered as discretionary consumption. The dominant categories of online sales include electronics, clothing and footwear, kitchen utensils, books and entertainment, fitness equipment, and collectibles, which are not pressing consumption needs and many of the products are not necessities. Therefore, when inflation leads to an increase in necessary living expenses, these non-essential expenses will naturally decrease.

Traditional overseas warehouses need to shift to omnichannel

Traditional overseas warehouses provide simple storage and manual labor services, with a low entry threshold and easy access to the industry. Most emerging overseas warehouses born from online bonuses are of this type and only offer basic services without the ability to provide detailed services or support systems. Especially for overseas warehouses established in advantageous locations, such as those in Los Angeles and New Jersey, most of them are due to their port locations and therefore provide port drayage and discharge services.

No Open Box Service vs Open Box Service

The “No Open Box” service refers to storing goods without opening the boxes for a period of time after they arrive at the overseas warehouse. On the other hand, the “Open Box” service requires opening the boxes and performing local storage and inventory management, as well as fulfilling the order and performing additional operations such as local packaging. The latter requires a much higher level of sophistication from the overseas warehouse, as it involves many more steps and a strong system support (such as WMS). Common warehouse management software can be purchased from the market, but custom development is only possible if the overseas warehouse has its own software development team, which is almost impossible for most overseas warehouse operators. Therefore, if the overseas warehouse has its own software development capability, it truly stands out as a unique competitive advantage.

Return handling and value recovery

The return rate of online sales in the US market is 15%, which means on average, 15% of the goods returned by consumers cannot be sold and will result in a loss of value for the company and ongoing storage and labor costs. Effective processing of these returns can recover a significant portion of the value, greatly supporting the overall business operations. However, processing returns requires specialized technology, especially for electronic products refurbishing, and it’s not just finding a foreign warehouse.

Expanding local offline sales channels

As the online sales market begins to contract, life for sellers on e-commerce platforms will become increasingly difficult, and competition will become increasingly fierce. Small and medium-sized sellers have already suffered and many have started to withdraw, selling off leftover inventory to exit online sales. Another solution besides retreating is to expand into markets outside of the online market, including wholesale and offline retail markets, to sell off leftover inventory. This requires the company to have a strong local presence in the US, either through a local team or a partner. Diversifying sales channels is critical for the development of cross-border companies in the US market, as relying on any single channel increases the risk of market fluctuations.

Overseas Warehouse Services Integration with Local Customer Operations

Overseas warehouses that only provide storage space and transportation services have a very low degree of coupling with customer business. To enhance the stickiness with customer business, overseas warehouses must become part of the customer’s local business.

Due to the current situation, more and more companies need to increase sales through exports, and even companies that used to not do cross-border trade are now considering it. These companies have no previous experience in cross-border sales, and even long-term cross-border e-commerce companies are only comfortable within large e-commerce platforms.

Therefore, the service of the overseas warehouse should be able to forward integrate a series of local business for cross-border companies, which is not just simple local storage and delivery. These businesses include building a local sales platform, expanding local sales channels, processing goods locally and handling returns, conducting local offline marketing and online marketing promotions. Basically, as soon as the goods are shipped out by the cross-border company, all subsequent operations can be completed by the US-based partner, of course, the cross-border company can still have its own team to handle business areas that it is good at, such as setting up online sales platforms and operating social media platforms.

Visit the AMAX Services homepage to get more information on their services.